Case Study

Insurance Management System

Context

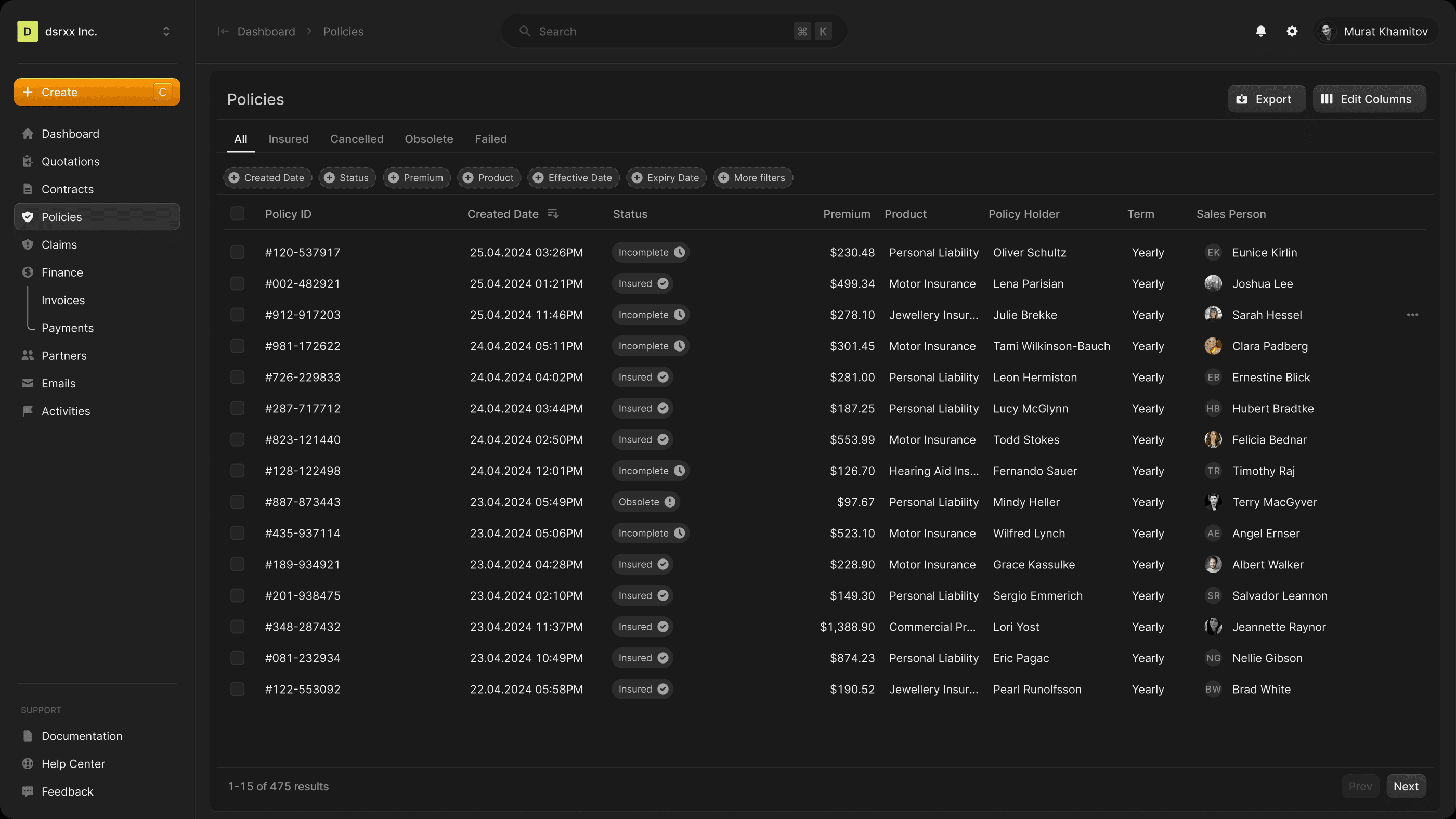

Insurance workflows are inherently complex—spanning underwriting, policy administration, endorsements, renewals, and claims. Existing tools were fragmented, heavily manual, and difficult to scale across different products, markets, and teams.

The goal was to design a unified system that could support multiple roles and workflows while remaining flexible enough to adapt to different insurers, regulatory requirements, and operating models.

Key constraints included strict compliance requirements, legacy processes, and the need to balance configurability with usability.

Role:

Product Design Lead

Timline:

2024

Scope:

Enterprise B2B platform

Industry:

Insurance technology

Approach

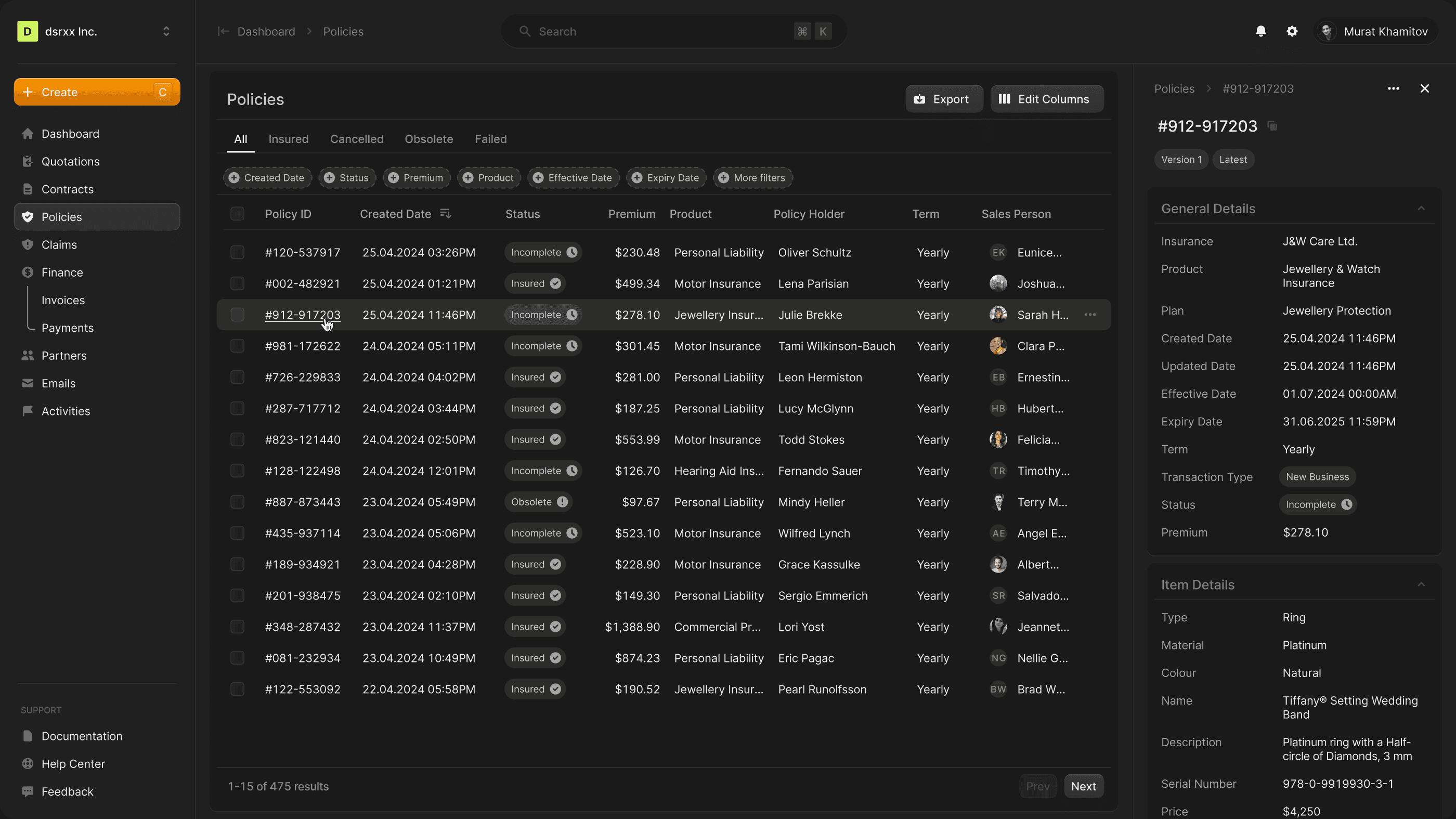

Rather than designing individual features in isolation, the focus was on building a system-first foundation.

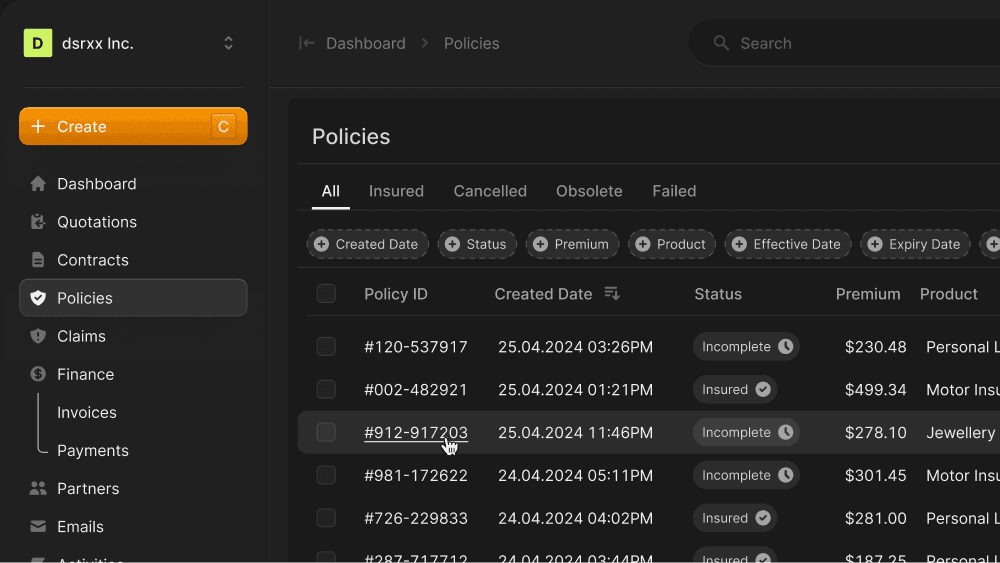

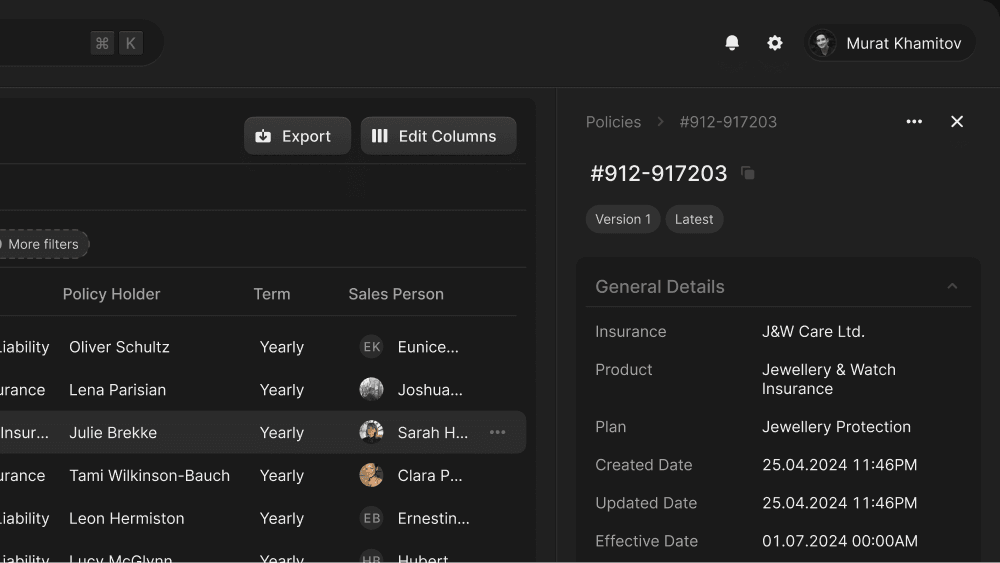

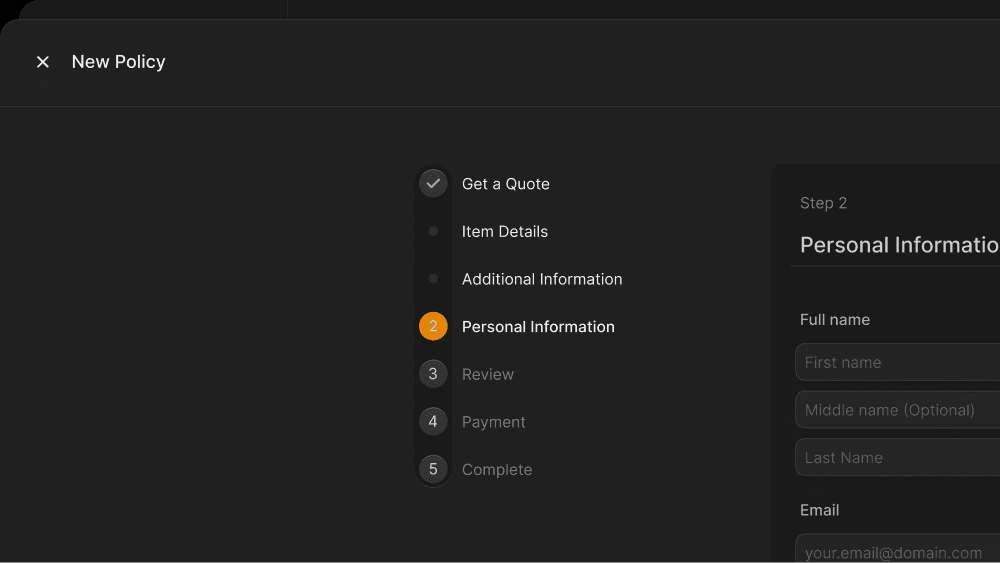

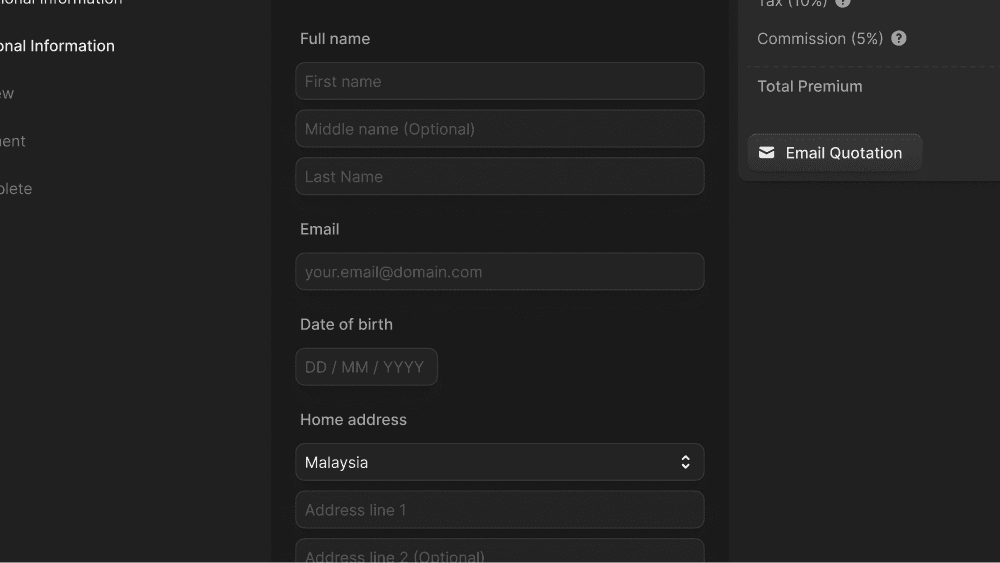

Work began by mapping core entities and workflows across underwriting, policy, and claims. From there, shared patterns were identified—allowing common components, layouts, and interactions to be reused across modules.

Design decisions were guided by a few core principles:

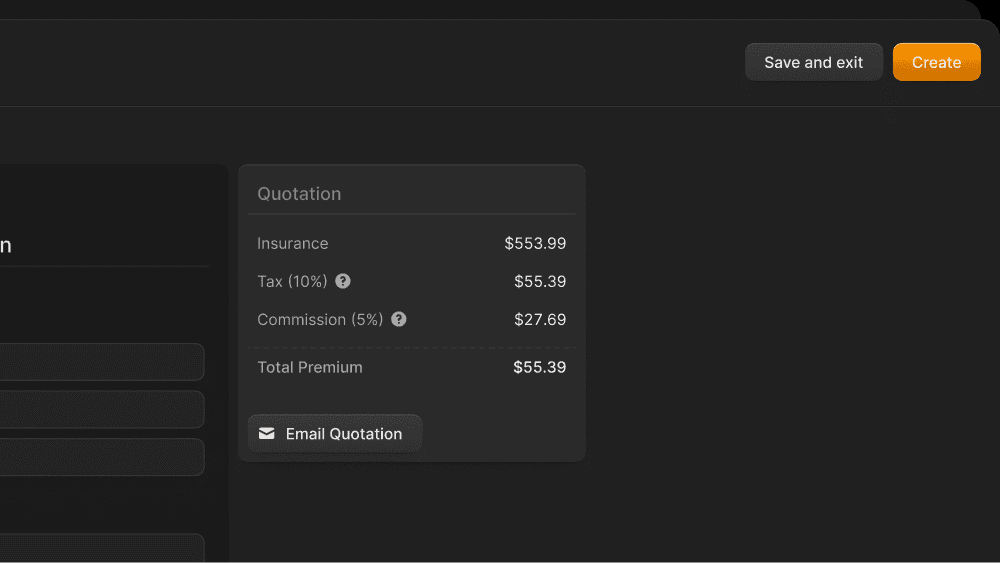

Prioritise clarity over density

Make complexity visible, not hidden

Design for multi-role, real-world workflows

Build flexibility into the system, not the UI

Close collaboration with engineering ensured designs were technically feasible and scalable from the start.

Outcome

The result was an end-to-end platform that unified previously fragmented workflows into a single, cohesive system.

Internal teams were able to onboard faster, manage policies more efficiently, and adapt workflows without heavy manual intervention. The system scaled across multiple products and use cases while remaining compliant with regulatory requirements.

Beyond immediate usability improvements, the platform established a foundation for future products and features to be built consistently and confidently.

Reflections

Designing for regulated environments reinforced the importance of embracing constraints rather than fighting them. By treating compliance and complexity as design inputs—not obstacles—the product became clearer, more resilient, and easier to evolve over time.

© 2026 Murat Khamitov